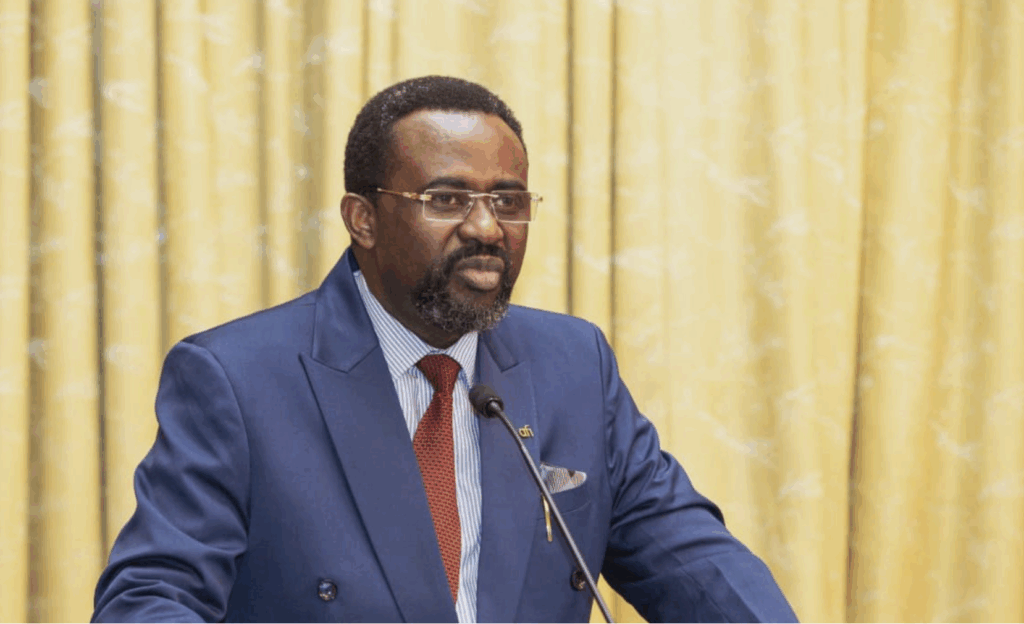

Dr Johnson Asiama, Governor of the Bank of Ghana (BoG), says Ghana’s macroeconomic conditions are showing early signs of stabilisation, but significant risks remain.

He said that although the inflation outlook was improving, it remained vulnerable to several factors.

“These include potential second-round effects, constraints on food supply, especially from northern Ghana and the Sahel, and external price shocks, particularly given the volatility in global commodity markets,” he said.

Dr Asiama was addressing the 124th Monetary Policy Committee (MPC) Meetings in Accra.

Inflation declined to 21.2 per cent in April 2025 but remained above the central bank’s medium-term target of 8 ± 2 per cent and the upper tolerance band of 19 per cent.

He cited geopolitical tensions and evolving global trade dynamics, including recent US-led tariff disputes, as developments that have increased market uncertainty.

These global trends could affect commodity prices, exchange rates, and financial flows in emerging markets like Ghana.

Dr Asiama emphasised the importance of MPC deliberations, stating the Committee would assess whether the current policy stance was sufficient to drive disinflation without hindering fragile economic growth.

Key focus areas, he noted, include the sustainability of the recent exchange rate appreciation, the durability of returning market confidence, and their implications for the medium-term inflation outlook.

Despite challenges, Ghana has secured a Staff-Level Agreement with the IMF on the Fourth Review of the Extended Credit Facility (ECF) Programme.

Standards and Poors, a rating agency, had upgraded Ghana’s sovereign rating from selective default to CCC+.

External reserves have also improved, the trade balance has strengthened, and consumer and business confidence indices continue to rise.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.